Powell Says What Investors Wanted to Hear, More Driving, and More Electricity

- Doug MacGray

- Aug 24, 2025

- 5 min read

August 24, 2025

FED CHAIR POWELL SPEAKS: Fed Chair Jerome Powell spoke from Jackson Hole on Friday. His remarks were described by many as "dovish," meaning the hardline stance on interest rates is likely coming to an end. At the last Fed meeting, two members of the Fed dissented to keeping rates the same saying that the inflation effect of tariffs will be short-lived. On Friday, Mr. Powell repeated those comments indicating he is coming over to their side. "[T]he shifting balance of risk may warrant adjusting our policy stance." Regarding labor, he said that both supply (because of immigration activity) and demand are decreasing creating some balance ("a curious kind of balance"), but he cautioned that this could change for the worse quickly. Given all that has occurred leading up to Friday's speech, it appears more likely that September will see a rate cut, and that it is more likely we will see more than one before the year is out.

A BIG FRIDAY SAVES THE WEEK: Early in the week, a tech selloff made it look like we were going to have another negative week. Sam Altman, CEO of Open AI said that the AI boom had some bubblelike characteristics. When stocks get as expensive as the U.S. tech sector, investors are often more quick to bail out. Palantir Technologies, a stock which is up well over 100% for the year, dropped by about 19% by midweek before recovering and being down just 9.9% by the end of the week. On Friday, Chairman Powell's speech changed everything. Investors were betting that Powell's speech would communicate continued caution, so when he did the opposite, the buying began. The NASDAQ still ended the week negative (down 0.58%), but tech stocks removed much of their losses for the week on Friday. Small cap stocks, represented by the Russell 2000, roared, up nearly 4% on Friday, and ending the week up 3.3%. Historically, smaller companies benefit more than large companies when interest rates decrease.

LONGER-TERM PERFORMANCE: Below are the annualized three-year and five-year numbers for these same indices.

SALES OF EXISTING HOMES INCREASED IN JULY: Sales of existing homes increased 2.0% in July according to the National Association of Realtors. But, this was after June's results came in at a nine-month low. The average annual pace in the years leading up to 2020 was about 5.25 million. In July, that number was 4.01 million, so we are still in low territory, historically. Median prices for homes have not moved much in the past year while wages have increased, improving affordability. There is a 15.7% increase in inventory from a year ago (see below). Furthermore, mortgage rates have moved modestly lower to about 6.7%. The fundamentals are creating slightly more favorable terms.

WE ARE DRIVING MORE: Average travel miles in the U.S. dropped when the government shut down much of the economy and remote work became ubiquitous. Travel rebounded dramatically thereafter. In April of 2025 (the last month of reporting) travel was 1.5% higher than the year before, and we are just about back to where we were before the shutdowns.

LOSING THE ELECTRICITY RACE: AI and the tech sector in general is driving significant economic growth, and will likely do so for years. A big side effect to this phenomenon is that the need for electricity has skyrocketed of late. According to GridStrategies, in 2022 the forecast for overall U.S. energy needs for 2029 was 4,375 TWh. One year later, in 2023, that forecast moved up to 4,553 TWh. In 2024, it was revised again to 4,773. China got a head start. As you can see below, the total electricity capacity of the U.S. and China in 2011 was roughly the same. Since then, China has poured it on, boosting capacity by 215% while the U.S. grew by 25%. In 2024, China added 429 gigawatts compared to 43 for the U.S.

A WEEK IN THE LIFE: August tends to be the slowest month for meetings at Stonecrop. People tend to be busy with end-of-summer activities and put off meeting until after Labor Day. But despite that, we have been keeping a steady stream of meetings and activity this August. I was just looking at my calendar for last week, and it shows the privilege I have. I had seven client meetings, and one meeting with potential clients. The clients consisted of a working widow, a semi-retired divorced woman, a working married couple within a decade of retiring, a retired couple trying to plan for a move to a senior living facility, a couple who are on the verge of a liquidity event due to the sale of the company for whom he is an owner, and a professional married couple in their thirties with two young children. On top of all that, I got in a round of golf at Biderman Golf Club here in Delaware, a mentoring session with a young entrepreneur (volunteer mentoring organization I work with), various internal meetings (less, now that I am no longer the President!), and then just all the work that goes along with this. (And all the while getting up early to train for my October marathon.) It truly is fun and rewarding work.

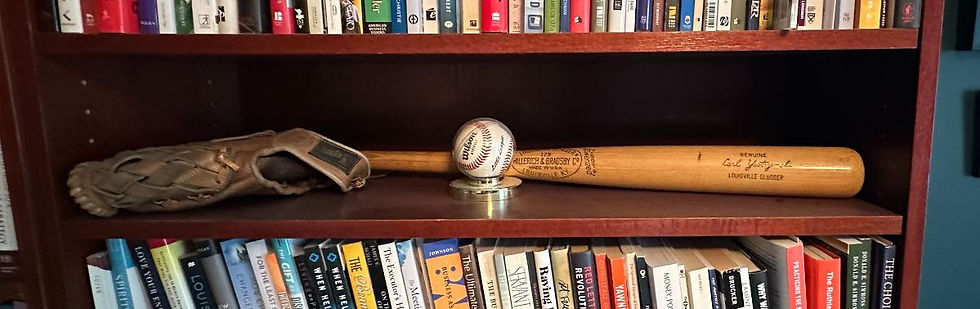

A COINCIDENCE I JUST DISCOVERED: Some of you know that I keep a baseball bat in my bookcase. For any of you who have been in a virtual meeting with me from my home office, you can see it right behind me, Here is a picture:

If you look closer, you can see that this is a Louisville Slugger bat with a Carl Yastrzemski autograph. This bat has a lot of sentimental value for me.

I just discovered that this very same bat was used in a classic horror film. Look very closely.

Stephen King is a Red Sox fan after all.

Have a great week!

Our purpose is to honor God by helping our clients see the objective, find the path, and navigate past the obstacles to a more prosperous future.

Douglas R. MacGray, J.D., C.F.P. ®

President

Stonecrop Wealth Advisors, LLC

Direct | Cell | Fax

(610) 628 4545

"Sometimes, I’ll be doing something to prepare for the next day or the next week, and then it hits me: You better look at the trees. Look at the trees right now. Look at the mountains right now. You might not be healthy next week, but right now you don’t have cancer in your body, and you should feel energy, and you should feel happiness. It can be taken away so quickly." Chris Evert

"Keep yourselves free from the love of money, and be content with what you have." Hebrews 13:5

SOURCES:

SALES OF EXISTING HOMES INCREASED IN JULY: https://www.ftportfolios.com/Commentary/EconomicResearch/2025/8/21/existing-home-sales-increased-2.0percent-in-july

FED CHAIR POWELL SPEAKS: https://www.zerohedge.com/markets/stocks-and-bonds-rally-powell-gives-nod-september-rate-cut-newsquawk-us-market-wrap AND https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm

WE ARE DRIVING MORE: https://www.fhwa.dot.gov/policyinformation/travel_monitoring/25aprtvt/

LOSING THE ELECTRICITY RACE: https://www.ftportfolios.com/Commentary/EconomicResearch/2025/8/21/powering-americas-future-insights-on-the-u.s.-electricity-growth-outlook

(c) 2025 Anno Domini, Stonecrop Wealth Advisors, LLC, All Rights Reserved

Investment advisory services offered through Stonecrop Wealth Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

SDG

*S&P 500: This is a measure of the performance of the 500 largest companies in the United States, and it a common index to track the performance of U.S. equity markets, especially the large cap markets.

*MSCI All Country World Index X US: This is a broad measure of the performance of worldwide equity markets excluding the United States.

*Bloomberg U.S. Aggregate: This is a measure of the U.S. bond markets.

_edited.png)

Comments