BBB, Mixed Economic Signals, and a Big Anniversary

- Doug MacGray

- Jul 6, 2025

- 3 min read

July 6, 2025

THE "BIG BEAUTIFUL BILL": Congress finally passed, and President Trump signed into law, the bill officially known as the "Big Beautiful Bill." The 2017 tax cuts that were set to expire on January 1, 2026 are now permanent. There are now additional income tax deductions for tip income, overtime income, and senior income. The tax deduction for state and local income taxes was increased from $10,000 to $40,000. The federal estate tax exemption will increase to $15 million per person, and increase with the inflation rate. For those who do not itemize their taxes, there will be a new $1,000 charitable deduction ($2,000 for joint filers). The bill has a lot more to it (it is over one thousand pages). We are just now jumping into all the details. We will be digging deeper into this new law and giving you more information as we learn more about it. Of course the big question on the minds of many is this: What will this new law do to the economy and thus the markets? That will take some time to determine. The biggest current concern seems to be its potential for increased government deficits which of course we will watch very closely.

POSITIVE EMPLOYMENT REPORT: The United States economy added 147,000 new jobs in June. This was more than most economists had projected. The unemployment rate lowered a bit from 4.2% to 4.1%. Private payrolls were only up by 74,000. Half the gains were government jobs. Wages in June were 3.7% higher than one year ago.

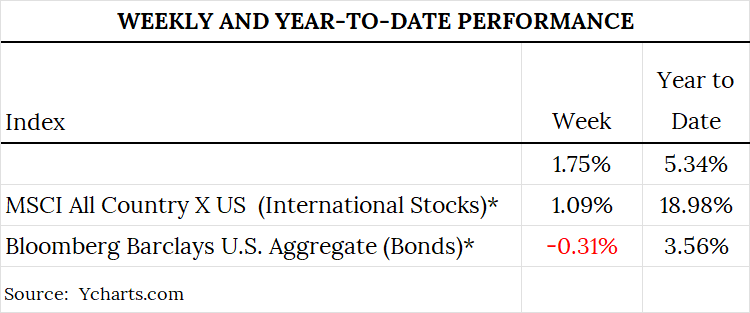

STOCKS KEEP RISING: In a holiday-shortened week, stocks rose once again. Late in the week, investors were encouraged by the U.S. jobs report. Economists polled by the Wall Street Journal expected 110,000 new jobs, so the report surprised to the upside. The report also revised the last couple of months up a bit which also fueled some optimism. It also appears that the prospect of the final passage of the new tax bill was causing some investor optimism (a failure would have created a lot more uncertainty).

LONGER-TERM PERFORMANCE: Below are the annualized three-year and five-year numbers for these same indices.

CONTINUING INFLUENCE OF THE MAGNIFICENT SEVEN: Apple, NVIDIA, Microsoft, Amazon, Tesla, Alphabet, and Meta (The Magnificent Seven) currently make up 31.5% of the S&P 500 Index. In the first half of 2025, they contributed just 14.5% of the Index’s 6.2% total return. Three of the seven declined: Tesla dropped 21.3%, Apple decreased 17.9%, and Alphabet declined 6.7%. Gains were led by Meta (+26.3%), Microsoft (+18.5%), and NVIDIA (+17.7%).

U.S. SERVICES SECTOR BACK TO GROWTH: The Institute for Supply Management's Services index indicates growth if above 50 and contraction if below. After one month of contraction in May, the ISM Services index was back in growth territory (barely) at 50.8% in June. New orders and business activity were responsible for the slight increase to the index. Uncertainty over trade policy, high interest rates, and Middle East tensions are said to be delaying business activity and capital investment.

U.S. MANUFACTURING STILL SHOWING DECLINE: The ISM Manufacturing sector index came in at 49 showing contraction for the fourth consecutive month. The score was 49.0. This index was in contraction for all of 2023 and 2024. The index got back into positive territory in January and February of this year, but that was short-lived.

A BIG ONE: My wife and I spent some time at our favorite resort over the long weekend to celebrate a very big anniversary. The picture on the right below is my view while drafting this email..

Have a great week!

Our purpose is to honor God by helping our clients see the objective, find the path, and navigate past the obstacles to a more prosperous future.

Douglas R. MacGray, J.D., C.F.P. ®

President

Stonecrop Wealth Advisors, LLC

Direct | Cell | Fax

(610) 628 4545

"We hold these truths to be self-evident: that all men are created equal; that they are endowed by their Creator with certain unalienable rights; that among these are life, liberty, and the pursuit of happiness." Thomas Jefferson

"Proclaim liberty throughout all the land unto all the inhabitants thereof" Leviticus 25:10

SOURCES:

POSITIVE EMPLOYMENT REPORT: https://www.ftportfolios.com/retail/blogs/economics/index.aspxvU.S . SERVICES SECTOR BACK TO GROWTH: https://www.ftportfolios.com/Commentary/EconomicResearch/2025/7/3/the-ism-non-manufacturing-index-increased-to-50.8-in-june

U.S. MANUFACTURING STILL SHOWING DECLINE: https://www.ftportfolios.com/retail/blogs/economics/index.aspx

CONTINUING INFLUENCE OF THE MAGNIFICENT SEVEN: https://www.ftportfolios.com/Commentary/EconomicResearch/2025/7/3/sp-500-index-1h-a-broader-market-awakens

(c) 2025 Anno Domini, Stonecrop Wealth Advisors, LLC, All Rights Reserved

Investment advisory services offered through Stonecrop Wealth Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

SDG

*S&P 500: This is a measure of the performance of the 500 largest companies in the United States, and it a common index to track the performance of U.S. equity markets, especially the large cap markets.

*MSCI All Country World Index X US: This is a broad measure of the performance of worldwide equity markets excluding the United States.

*Bloomberg U.S. Aggregate: This is a measure of the U.S. bond markets.

_edited.png)

Comments