Inflation Remains the Theme, and Your 21-Year-Old Self

- Doug MacGray

- Nov 17, 2024

- 3 min read

November 17, 2024

OCTOBER INFLATION: The Consumer Price Index increased by 0.2% in October, and the 12-month inflation number now stands at 2.6%. Last month this number was 2.4%. The Fed prefers to look at the CPI minus food and energy costs, and that twelve month number came in at 3.3%. There were no surprises here.

RETAIL SALES SPIKE: According to the U.S. Census Bureau, in October, U.S. retail sales increased by 0.4% from the previous month. In addition, the Bureau revised its numbers for September. Previously the Bureau reported that September's growth was up 0.4% from the prior month, but this was revised up to 0.8%.

FED CHAIR POWELL'S COMMENTS: Fed Chair Jerome Powell made some comments last week, and here are two important quotes:

"The recent performance of our economy has been remarkably good, by far the best of any major economy in the world."

"The economy is not sending any signals that we need to be in a hurry to lower rates."

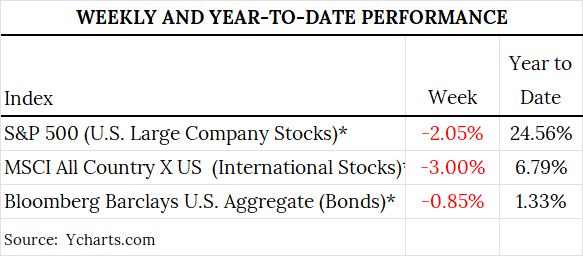

STOCKS PULL BACK: Stocks gave back about half of their prior week's gains last week. Strong retail sales, ambiguous inflation results, and noncommittal comments made by Fed Chairman and other members of the Fed caused stocks to pull back. Investors are growing more uncertain about whether the Fed is going to continue cutting interest rates, and if so, the timing of such cuts. If the economy continues to hold up well, it may take the incentive away from the Fed to move rates down decisively. Some volatility is expected as a new government begins to take shape as it creates uncertainty and speculation, none of which are comforting to the investing public. For example, with the naming of Robert F. Kennedy Jr. as nominee for Secretary of Health and Human Services, pharmaceutical stocks moved down over 4% for the week.

LONGER-TERM PERFORMANCE: Below are the annualized three-year and five-year numbers for these same indices.

U.S. INDUSTRIAL PRODUCTION SLOWS: According to the Federal Reserve, industrial production in the U.S. (mining, utilities and manufacturing) decreased by 0.3% in October after a 0.5% decline in September. Industrial production in October was 0.3% lower than one year ago.

PEOPLE DON'T LIKE INFLATION, AND THEY BLAME THE GOVERMENT: According to a recent article in the Financial Times, 2024 is the first year since at least 1905 that the governing parties in the democratically elected governments lost elections in every election that took place. A common factor in 2024 were governments running for reelection on the heels of much higher prices since 2021, when governments followed shutdowns with re-openings and stimulus, followed by inflation.

WHAT WOULD YOU TELL YOUR 21-YEAR-OLD SELF?: I was invited to a dinner last week of eight people. The organizer, and chef for the night, asked us to show up with an answer to this question: "What would you tell your 21-year-old self." I am now at a point that my current self and my 21-year-old self do not have a lot in common. But boy oh boy would I have a lot to tell that guy. The real question is, would he listen? Anyway, I heard some interesting answers. I went second, and the woman to my right who went after me started with, "well, I don't think I will go quite as deep as his answer,...." You know what they say, "Go deep or go home."

Have a great week!

Our purpose is to honor God by helping our clients see the objective, find the path, and navigate past the obstacles to a more prosperous future.

Douglas R. MacGray, J.D., C.F.P. ®

President

Stonecrop Wealth Advisors, LLC

Direct | Cell | Fax

(610) 628 4545

"Your true character is most accurately measured by how you treat those who can do nothing for you." Mother Teresa

"Because we know that suffering produces perseverance; perseverance, character; and character, hope." Romans 5:4 (NIV)

SOURCES:

PEOPLE DON'T LIKE INFLATION, AND THEY BLAME THE GOVERMENT: https://theovershoot.co/p/will-trumps-win-eventually-lead-to

RETAIL SALES SPIKE: https://www.census.gov/retail/sales.html

U.S. INDUSTRIAL PRODUCTION SLOWS: https://www.federalreserve.gov/releases/g17/Current/default.htm

OCTOBER INFLATION: https://www.bls.gov/news.release/cpi.nr0.htm

FED CHAIR POWELL'S COMMENTS: https://www.federalreserve.gov/newsevents/speech/powell20241114a.htm

STOCKS PULL BACK: YCharts.com

(c) 2024 A.D., Stonecrop Wealth Advisors, LLC, All Rights Reserved

Investment advisory services offered through Stonecrop Wealth Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

SDG

*S&P 500: This is a measure of the performance of the 500 largest companies in the United States, and it a common index to track the performance of U.S. equity markets, especially the large cap markets.

*MSCI All Country World Index X US: This is a broad measure of the performance of worldwide equity markets excluding the United States.

*Bloomberg U.S. Aggregate: This is a measure of the U.S. bond markets.

_edited.png)

Comments