War, Labor Pains, and Confused Investors

- Doug MacGray

- Oct 8, 2023

- 4 min read

Updated: Oct 23, 2023

October 8, 2023

WAR: Hamas launched a surprise attack on Israel on Saturday, its biggest in years. Israel’s Prime Minster announced that “the enemy will pay an unprecedented price.” and declared war on Hamas. This is dominating the news this weekend and will likely continue to do so in the coming weeks. It seems inevitable that many more people will die in the short term. Let’s hope and pray this ends quickly and in a manner that does not lead to a greater war. The hatred and violence and carnage on the TV screen right now is disheartening to say the least.

336,000 NEW JOBS IN SEPTEMBER: The United States economy added 336,000 new jobs in September, the most since January. The unemployment rate remained at 3.8%. The Labor Force Participation Rate did not change, staying at 62.8%. The initial reaction to this report was that it was too strong, and it will cause the Fed to tighten even further. But wage growth numbers were not strong (see below). Also, the government added a significant number of those jobs, many of them teachers. A disproportionate number of new jobs were part-time workers. In addition, a significant jump in workers with multiple jobs, 123,000, occurred, indicating that inflation is causing many to work multiple jobs to pay the bills. In fact, the number of people with two full-time jobs in the economy hit an all time high in September.

WAGE GROWTH SOFTENS: The September jobs report seemed to indicate a hot jobs market, but the wage growth numbers showed that perhaps the labor market is not as strong as the headline suggested. September wage growth was only 0.2% from the prior month. Year-over-year wage growth peaked at 5.9% in March 2022, and has now come down to 4.2%. On an annualized basis, the wage increase in September was 2.5%. During the last three months, wage growth has been averaging 3.4% annualized. While the number of new jobs caused initial panic on Wall Street (because it will cause the Fed to get more aggressive to cool the labor market), the wage growth numbers calmed fears and led to a rally.

FRIDAY RALLY CREATES A POSITIVE WEEK: As the week rolled on, stocks continued to be slightly negative. When the U.S. jobs report was released on Friday showing the most monthly new jobs since January (see above), markets were rattled, and stocks fell. But when investors dug into the jobs report more, they discovered the softening wage growth numbers. This relieved investors who were worried that the jobs report would continue to push the Fed to more restrictive measures. That relief led to a strong rally on Friday. Bonds continue to suffer as it becomes clearer that the Fed will keep rates higher for longer. Lowered bond prices, and higher bond yields, are a headwind for stock values, and this has been a drag on the markets for the past month or so.

LONGER-TERM PERFORMANCE: Below are the annualized three-year and five-year numbers for these same indices.

HEAVY TRUCK SALES SOLID: During the Great Recession, sales of heavy trucks in the U.S. fell to a low of 180,000 in May of 2009. The record high was hit in April 2019, 570,000. When the government began shutting down parts of the economy in 2020 sales fell again to 308,000 in May 2020. Last month, sales were 513,000, down from 544,000 in August, but up 5% from a year ago.

LUMBER RELIEF: The price of lumber in the U.S. was 11% lower in September than they were a year ago.

U.K. INFLATION TICKS DOWN: The annual inflation rate in the U.K. moved down to 6.7% from 6.8% a month ago. Most economists were predicting an uptick. The U.K. has been experiencing inflation higher than the U.S. and across most of Europe.

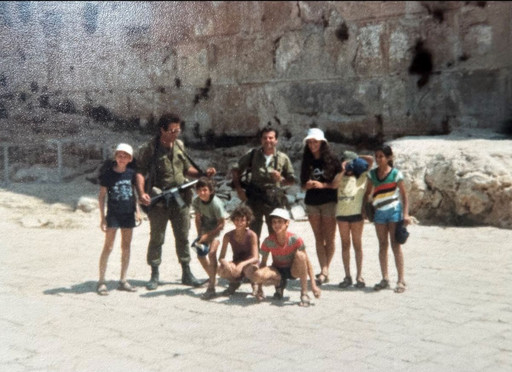

A TOURIST IN ISRAEL: Many years ago (a college trip in fact), I had the privilege to visit Israel. It was one of the most memorable experiences of my life. I had very little money back then. I had a Kodak Instamatic camera with a limited amount of film. So I don’t have a lot of pictures. But here are two, one of yours truly, younger and hairier to be sure, in Bethlehem. I took the other picture of tourists and armed guards at the burial place of Abraham. It was a novelty to see soldiers casually walking around with machine guns…not such a novelty anymore unfortunately.

Have a great week!

Our mission is to help you see the objective, find the path, and navigate past the obstacles to a more prosperous future.

President

Stonecrop Wealth Advisors, LLC

Direct | Cell | Fax

(610) 628 4545

“Don’t aim at success. The more you aim at it and make it a target, the more you are going to miss it. For success, like happiness, cannot be pursued; it must ensue, and it only does so as the unintended side effect of one’s personal dedication to a cause greater than oneself or as the by-product of one’s surrender to a person other than oneself. Happiness must happen, and the same holds for success: you have to let it happen by not caring about it. I want you to listen to what your conscience commands you to do and go on to carry it out to the best of your knowledge. Then you will live to see that in the long-run—in the long-run, I say!—success will follow you precisely because you had forgotten to think about it” Victor Frankl, Man’s Search for Meaning

“Whoever would love life and see good days must…seek peace and pursue it.” I Peter 3:10-12 (NOV)

SOURCES: 336,000 NEW JOBS IN SEPTEMBER: https://www.bls.gov/news.release/empsit.nr0.htm AND https://www.zerohedge.com/markets/inside-todays-jobs-report-885000-full-time-jobs-lost-offset-1127-million-part-time-jobs WAGE GROWTH SOFTENS: https://www.wsj.com/economy/jobs/jobs-report-september-economy-unemployment-d9409b8b?mod=article_inline HEAVY TRUCK SALES SOLID: https://www.calculatedriskblog.com/2023/10/heavy-truck-sales-solid-in-september-up.html LUMBER RELIEF: https://www.calculatedriskblog.com/2023/10/update-lumber-prices-down-11-yoy.html U.K. INFLATION TICKS DOWN: https://www.wsj.com/economy/global/u-k-inflation-falls-unexpectedly-easing-pressure-on-bank-of-england-bdaa4bdc?mod=economy_feat2_global_pos3

(c) 2023 A.D., Stonecrop Wealth Advisors, LLC, All Rights Reserved

*S&P 500: This is a measure of the performance of the 500 largest companies in the United States, and it a common index to track the performance of U.S. equity markets, especially the large cap markets. *MSCI All Country World Index X US: This is a broad measure of the performance of worldwide equity markets excluding the United States. *Bloomberg U.S. Aggregate: This is a measure of the U.S. bond markets.

Investment advisory services offered through Stonecrop Wealth Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

_edited.png)

Comments